Council must balance its service levels with the needs and expectations of the community and set appropriate levels of tax to adequately fulfill its roles and responsibilities.

The aim of rates and charges decision-making is to spread the burden fairly across the community with those that have the greatest capacity to pay paying more than those with a lessor capacity to pay.

When considering how the rate burden will be distributed, Council must balance capacity to pay with the benefit principle acknowledging that there are some groups of the community that have more access to and benefit from specific services.

You can click here to pay rates online now

or use one of the payment methods below:

Telephone

If you hold a Visa or MasterCard, you can call 1300 276 468, 24 hours a day, every day. Please have your rates notice with you when paying by phone.

Note that this is the BPOINT phone number.

BPay

You can pay your rates via online banking. Contact your bank of financial institution to make payment from your cheque, savings, debit or transaction account. Please refer to your rates notice for your BPay reference number.

Payment in person

Bring along your intact rates notice to make a payment at the Council Offices, 21 Saunders Street, Wynyard.

Payments can be made between the hours of 9am and 4.30pm – Monday to Friday.

Cheques or money orders should be made payable to Waratah-Wynyard Council and posted to:

Waratah Wynyard Council

PO Box 168

Wynyard TAS 7325

Note: Receipts will not be provided unless requested.

To achieve this balance the rating structure comprises two types of rates – general and service rates.

General Rate

The general rate is calculated on a cent in the dollar amount, based on the AAV of a property. Property values generally reflect the capacity of the ratepayer to pay. Those with a higher AAV pay more than those with a lower AAV.

Service Rates

Service charges are designed to reflect payment based on access or usage of services provided by Council. The charges are set to recover the cost of the specific service/s provided. Council levies service charges for the following services:

Storm water – Covers maintenance & upgrade of connections, drainage, and storm water removal systems including from roads and funds programs to improve municipal storm water removal systems.

Waste management – Covers waste collection including recycling and running the waste management centre, the provision of waste vouchers to ratepayers and other municipal waste services.

Fire levy – This charge is collected on behalf of the state fire commission for fire protection services.

Council’s Rates and Charges Policy outlines Council’s approach to determining and collecting rates from the community.

Council must, by law, use property valuation data issued by the Office of the Valuer-General to levy its Rates. The Office of the Valuer General conducts municipal wide fresh revaluations on a six-yearly cycle. Council was last subject to a municipal wide revaluation with an effective date of 1 July 2016.

The full revaluation schedule for Councils in Tasmania have been delayed due to COVID-19. The full fresh municipal revaluation will occur in the 2023/24 financial year and will come into effect for rating purposes from 1 July 2024.

Adjustment factors are issued every two years by the Office of the Valuer General In order to keep pace with market changes between revaluations.

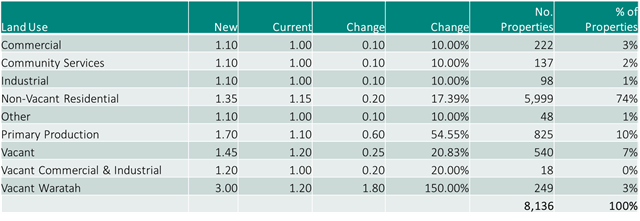

Due to the delay in full fresh valuations, Council has received adjustment factors that must be applied for 2022/23 rating. The table below shows the adjustment factors applied to each property class in the municipal area.

Overall property values have increased by approximately 22% on average across the municipal area since the last adjustment was applied. Waratah vacant land and Primary Production properties have seen the most substantial change in property values.

Council does not collect more rates as a result of these changes. However, what does occur is a change in the distribution of the rate burden payable between properties. Property values that go up more than the average pay more. Property valuations that have gone up by less than average pay less.

As a result, of the valuation changes, there will be a shift in rate burden to Primary Production properties in the coming rating year. The General Rate paid by primary production properties continues to be comparable to other primary production businesses in the region.

Whilst Waratah vacant land has also received a significant increase in property value, these properties predominantly pay the minimum General Rate and will not be as significantly impacted.

Council has increased the General Rate by 3.81% (less than the Council Cost Index of 4.06%). It is expected that of the 8,141 properties, 3,060 will receive increases greater than 3.81%, whilst 5,081 will receive an increase less than 3.81%.

Rate bills are expected to be sent to ratepayers in the week commencing 27 July 2022.

Further information on Adjustment Factors can be found here.

Pensioners Eligible for Assistance

Pensioners eligible for assistance under the Local Government (Rates and Charges Remission) Act 1991 may receive a rebate of rates and charges on their principal place of residence up to a maximum amount in any given year.

The Act defines the holder of any of these three card types to be an eligible pensioner for rates remission purposes:

- Pensioner Concession Card;

- Heath Care Card; or

- Repatriation Health Card.

The card must have a date of grant on or prior to 1 July of the year to which the rate remission relates.

Note: The possession of an Australian Government Seniors Health Card does not qualify the holder for a rates remission.

The applicant must be liable to pay the rates on the property that they occupy as their principal place of residence. In the case of joint ownership, at least one of the owners must meet the eligibility criteria. There is a limit of one remission per year per pensioner household.

Any pensioner who has not previously received a remission must complete an application form – available by contacting Council.

You can choose to pay your rates in full or by instalments throughout the year.

Ratepayers electing to pay their rates in full by 31st August will receive an early payment discount of 5%.

The due dates for instalments are now:

1st Instalment – 31 August

2nd Instalment – 31 October

3rd Instalment – 31 January

4th Instalment – 31 March

If you are having trouble paying your rates by the due dates and do not have a confirmed payment arrangement in place, please contact our Rates Officer on 6443 8323 or email council@warwyn.tas.gov.au to arrange a payment plan.